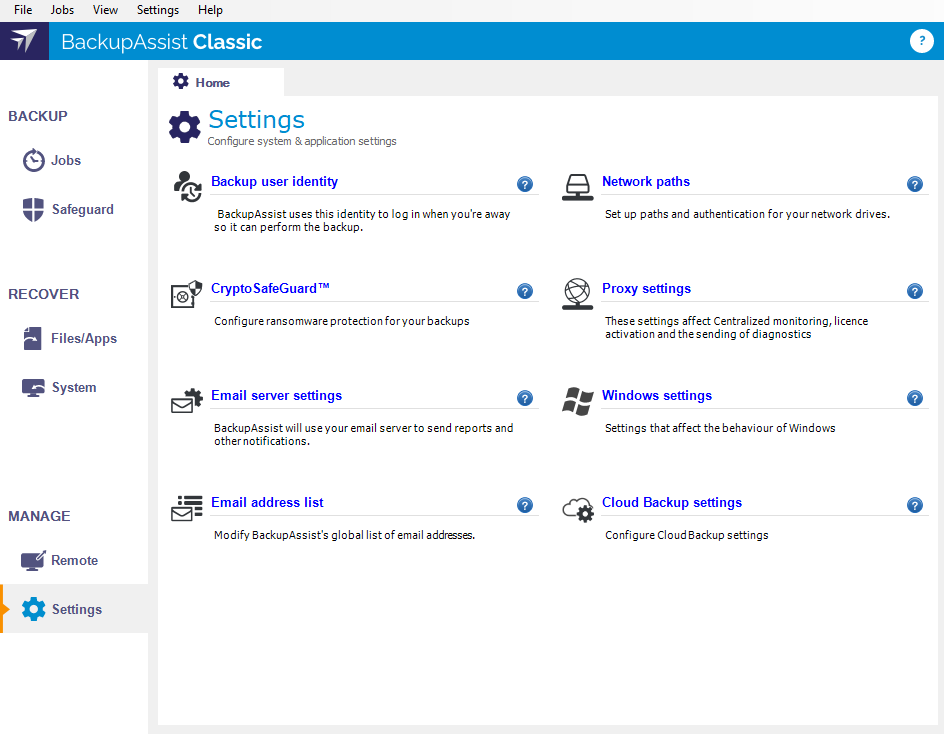

A chat box appears in the corner of the web page offering the visitor to receive quick help and eliminating the need to search the site for a phone number or email address. This response was very poor, considering sales leads are lost if they don’t receive a response after the first five minutes. Half of the survey participants disclosed that they spent 10-20 minutes per week on hold. No waiting timesĪ 2013 survey conducted by ResearchNow showed that people spend an average of 43 days on hold in their lifetime. What’s in it for you?Ħ Reasons why extending your CRM with messaging and chat will boost your customer relations 1. Now, enough about the functionality, although we could gladly go on about it forever. As you know, closing a deal often requires more than a phone call and having an ongoing conversation will improve your chances to get there. Lime chat is all about maintaining your customer relationships and taking it one step further by personalizing the messaging experience. All these messages are gathered in one inbox and seamlessly integrated in your Lime CRM.

The add-on offers both website messaging for your website and messaging solutions through your customer’s favorite channels such as WhatsApp, Facebook Messenger, and SMS. What is Lime Chat?įirst things first, what are we even talking about here? Lime Chat is our brand-new integration for creating and nurturing customer relationships across different messaging channels.

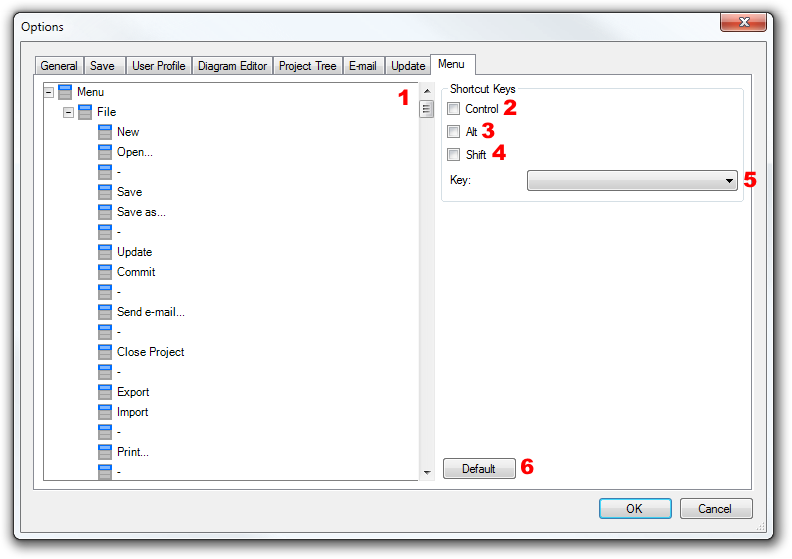

In this article, we are going to focus on pinpointing the value from integrating a live-chat system and how it will benefit you and your customers. This will help you get better at reading the table and seeing how options prices are related to the other information in the table.ĭisclosure: No positions at time of writing.Ĭlick here to read the original article on up your Lime CRM with a next-gen live chat experience from ground breaking Userlike, our latest acquisition. Spend some time looking through the tables and seeing how the options are priced–using the Last price or Bid and Ask price–for varying expiry dates and strike prices. Yahoo! Finance offers simple and relatively easy-to-understand options tables, although options pricing information is available from many other online sources including the CBOE website. Vega: The measure of how an options price reacts to changes in volatility in the underlying asset. Theta: A measure of the dollar amount the option price loses each day as it approaches expiry, known as time decay. Gamma: Since Delta is not stagnant, and will constantly be changing, Gamma is the measure of how much the Delta changes as the value of the underlying security changes. ĭelta: Represents how sensitive an options price is to the price movements in the underlying asset. While these figures are not shown on all options tables, a basic understanding is helpful when trading options.

#LIMECHAT OPTIONS TAB SERIES#

The Greeks are a series of calculations that help determine how an options price moves relative to the underlying asset. Open Int (Interest): The number of open positions in the contract that have not yet been offset. Options that have large volume typically have a tighter Bid-Ask spread since more traders are looking to get in and out of positions. Vol (Volume): Lets you know how many contracts have been traded during the session. Since one option is for 100 shares, to get the cost of an option you must multiply this price by 100. If you market buy an option, you’ll typically get this price assuming instant execution. Since one option is for 100 shares, to get the cost of an option you must multiply this price by 100.Īsk: The price at which sellers are trying to sell the option. If you market sell an option, you’ll typically get this price assuming instant execution. Last: The price of the last trade that went through.Ĭhg (Change) : Change is how much the Last price has changed since the previous close.īid: The price at which buyers are trying to buy the option.

0 kommentar(er)

0 kommentar(er)